Time in the market

With NS&I offering 6.2% on a twelve-month fixed-rate bond and equity portfolios delivering lacklustre returns, it might be tempting to cash out of your portfolio and move it all into cash. However, this could be a mistake.

Three reasons to consider staying invested.

There are three main reasons why it is important to stay invested, even during times of higher interest rates:

- Equities outperform cash over the long term. Over the long term, equity portfolios have outperformed cash, even when accounting for short-term volatility. This is because equities represent ownership in companies, and companies tend to grow their profits and dividends over time.

- Inflation erodes the value of your cash. Inflation is the rate at which prices for goods and services rise over time. If inflation is higher than the interest rate you are earning on your cash, then the real value of your money is decreasing.

- You can't time the market. It is impossible to predict when the stock market will go up and down. If you sell your investments when the market is down, you risk missing out on the subsequent recovery.

Example

Let's say you have £10,000 in cash today and you receive 4% per year. In three years' time, you will have £11,272. However, if inflation is running at 6%, the real value of your savings will actually only be £9,423.22. This is because you will be able to buy less with your money than you can today.

The importance of staying invested

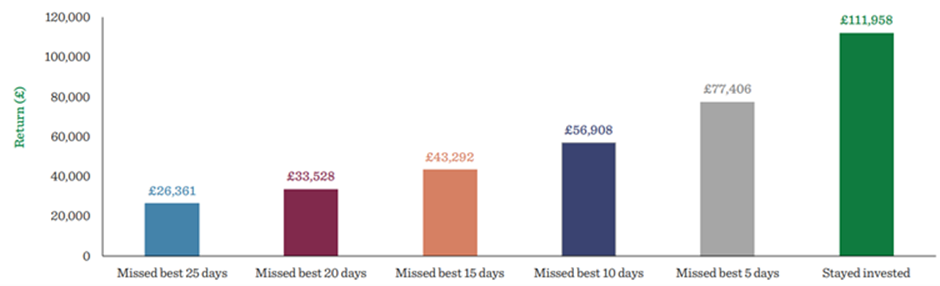

The chart below illustrates that someone who invested in global equities over the past 30 years could have earned a potential return more than four times greater than that of someone who missed out on the best days. This shows that if you lose out on the big gains, it has an outsized impact on an investment versus staying invested.

Source: Quilter Investors. MSCI All Country World Index between 30/06/1993 – 30/06/2023. Assumes a starting investment of £10,000.

The other problem with trying to time the market now in reaction to higher cash rates and poorer than hoped equity returns is that it essentially crystallizes any existing losses. It doesn't give client portfolios time to recover, which will be exacerbated if money is moved out of tax-wrapped assets like ISAs into fixed-rate accounts where previous allowances could be lost forever.

If you are considering cashing out of your investments, I urge you to first speak to a financial adviser. Over the long term, staying invested in equities is possibly the best way to grow your wealth.

Contact us now to discuss the benefits of long term investing.

This article is for information purposes only and should not be taken as advice. Please speak to your financial adviser if you require further information.

The value of units can fall as well as rise, and you may not get back all of your original investment.

Tax planning advice is not regulated by the Financial Conduct Authority.